04

When it comes to tracking progress, the type of data you use matters.

The right data can make tracking progress easier and more accurate. It has enough detail to provide your company with an accurate picture of your progress, but not so much that it creates unnecessary complexity and cost without adding value. What constitutes the right data, however, will vary depending on the company and circumstances.

In this chapter, we’ll look at the different types of data for tracking progress, how to determine which is best suited for your company, and when and how to make the switch from secondary to primary data.

There are two types of data used for tracking progress: primary and secondary.

Primary data:

Primary data is data collected directly by a company or its partners along the value chain. It can be obtained in a number of ways, most commonly through field measurement, using techniques such as remote sensing tools or various sampling approaches. Examples of primary data include the exact amount of energy consumed by a supplier at a plant you source from, or the amount of fertilizer used by the farmers you source from.

Primary data is often more costly and resource-intensive to gather than secondary data, so it’s important to understand whether or not the benefits you’ll gain from using primary data will outweigh the burden of collecting it before deciding to make the switch. We’ve outlined questions below to help you determine if primary data is required to help your organization achieve its goals.

Secondary data:

Secondary data, on the other hand, is not company or value chain specific. Obtained from databases, it’s derived from regional, country or global-level practices and trends or statistical information, and is typically used to model emissions in databases like ecoinvent or GaBi. Examples of secondary data include energy grid mixes, average fertilizer use in a given region, deforestation at the country level, or average truck fuel consumption for a certain model. Secondary data is efficient for assessing high-level emissions and is widely used in footprinting.

Though not company or value chain specific, it can provide useful information about the impacts of different practices or products by region. This can help you draw conclusions about your own impacts, including where the main sources of emissions lie in your company’s value chain, and where you should focus your efforts to get the best results. Secondary data may be preferable for companies that:

More precise and accurate data may become necessary the further a company advances along its transformation journey, particularly for reporting on annual progress towards emissions targets. Primary data, which by nature is more accurate and granular, may reveal that a company’s impact is more significant than previously believed. Though companies may be concerned that this could put them at a competitive disadvantage with peers using secondary data, the additional knowledge afforded by primary data will better enable them to effectively tackle impacts and focus resources where they’ll count.

A note on emissions factors

Primary and secondary data should not be confused with emissions factors. Primary and secondary data refer to the input data used to model emissions factors. Emissions factors, by contrast, are coefficients that convert activity data into GHG emissions data (i.e., kg CO2 emitted per liter of fuel consumed or per kilometer traveled). Primary emissions factors are often built using a mix of primary and secondary data, whereas, secondary emissions factors, sometimes referred to as generic emissions factors, do not rely on primary data.

Collecting primary data is a resource-intensive process, so it’s important to understand if and where it is likely to add value before making the switch. Consider the following questions to identify where collecting primary data may be worth the extra investment to improve data accuracy:

There are, however, two major situations where companies should strongly consider transitioning to primary data:

Accounting for removals

If you plan to account for emissions reductions and removals, you’ll need to collect primary data, which is mandatory under the draft GHG Protocol for Land Sector and Removals.

Improving supplier performance

In a scope 3 supplier engagement context, primary data can be used to benchmark suppliers’ emissions performance and identify levers of improvement, which could ultimately create opportunities to reduce your company’s scope 3 footprint.

If you determine that collecting primary data is the most appropriate course of action for your company, there are a few important things you’ll need to consider:

When transitioning from secondary to primary data you should anticipate that there may be some immediate impacts on your footprint. You may see improvements, reductions or benefits.

However, the act of collecting data in itself doesn’t generate any true impact. Instead, these outcomes (improvements, reductions or benefits) are the result of a methodological change that enables companies to more closely capture the real impact of targeted activities and monitor progress made following these interventions. As such, they don’t count as actual emissions reductions. Making this distinction from the get-go is critical to ensure that progress tracking is as accurate as possible.

Keep in mind that if this methodological change represents more than 5% of total base-year emissions, rebaselining will be necessary.

The following practices will help you ensure that the transition from secondary to primary data is a smooth one.

Determine if you really need to collect primary data.

Collecting extensive primary data can be an expensive and time-consuming exercise, especially if it doesn’t highlight improvements or bring additional insight. See above for the questions you can ask to determine whether it’s worth the effort.

Manage expectations.

Communicate clearly, and as early as possible, to internal stakeholders, particularly those in the C-suite, that the numbers will evolve when data collection techniques are updated.

Establish a clear data collection and quality assurance process.

If you don’t outline best practices and processes for collecting data, you could end up with data that is inconsistent and unusable. Take the time to develop clear, concise guidelines that include information on identifying and clarifying data sources, standard operating procedures for data collection, data quality requirements and third-party quality assurance requirements.

Distinguish primary activity data from primary emissions factors.

What you really want to collect is primary activity data, which will allow you to draw clear conclusions. However, you may receive primary emissions factors from a supplier. If this happens, you’ll need to review the scope and the underlying assumptions that went into the emissions factor. If there are variances with the generic emissions factors, which is likely, it’s important that you reach out to the source to understand why it varies from the numbers initially used.

Gain transparency over your supply chain.

Ultimately, your company’s ability to access (and benefit from) primary data is directly related to the level of transparency you have over your supply chain. Working to improve supply chain traceability and maintaining an up-to-date map of suppliers will put your company in a better position to (a) identify and assess the impact of its sourcing activities (energy consumption, land-use changes, etc.) and (b) switch progressively from secondary to primary data as your suppliers start implementing emission reduction initiatives.

We have answers. Get in touch with our team today and let us guide you through the solutions that might help you on your journey toward a sustainable supply chain.

01

This chapter covers what is considered real progress toward sustainability as you calculate and track changes in your supply chain.

Read

02

This chapter focuses on how to manage the double counting of emissions reductions when considering real progress toward a sustainable supply chain.

Read

03

This chapter covers why understanding the concept of supply sheds can help make more active progress and ensure companies will be able to claim progress.

Read

04 – Currently reading

Progress toward a sustainable supply chain hinges on the type of data one is using and why. Here we’ll differentiate the types of data and guide you to choose what’s right for your goals.

Read

05

This chapter dives deep into tools that rely on primary data and their implications for tracking progress in the supply chain.

Read

06

Progress toward a more sustainable supply chain is possible even with a fair amount of uncertainty. This chapter covers how to measure and manage uncertainty.

Read

Quantis partners with leading consumer goods and financial services organizations to drive sustainable transformation to operate within planetary boundaries.

We balance the latest science with business acumen to guide our clients to future-proof their business and thrive in a new planetary economy. We believe in the power of business to create a sustainable future where nature, people – and business – can thrive.

Get in touch with our team today and let us guide you through the solutions that might help you on your journey toward a sustainable supply chain.

We’ll use your data fairly, transparently and exactly as you want us to in compliance with GDPR. For all the details, read our Privacy Portal.

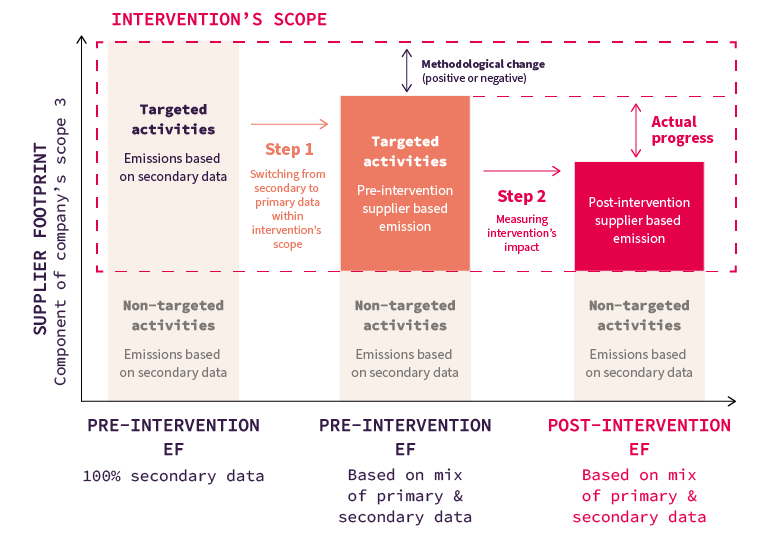

Switching from secondary to primary data to measure the progress and changes generated by an intervention at a supplier level.

The above graphic illustrates that:

You have 50% of the chapter left to read. Please share your email to continue the reading.

By submitting, you consent to allow Quantis to share sustainability-related content.

You can unsubscribe at any time. For more information, please review our Privacy Policy.

I’d rather not. Please take me home.